The Central Bank of Ireland has recently published its quarterly insurance newsletter. Insurance Ireland has put together a summary of the key topics, please find a link to the full newsletter below.

Navigating Covid uncertainty

Based on observations over the previous six months and in light of year end, the Bank share their expectations of sound and prudent management in an uncertain time. The Bank list key considerations that boards and executive leadership teams should reflect on including recent performance and the effectiveness of financial and risk management practices. The Bank also highlights the importance of reserving and business strategy decisions. In particular the Bank considered in further detail Solvency measurement and monitoring, adequacy of technical provisions, importance of ORSA as a management decision making tool and realism in setting business planning assumptions.

CP131 Recovery and Resolution Planning

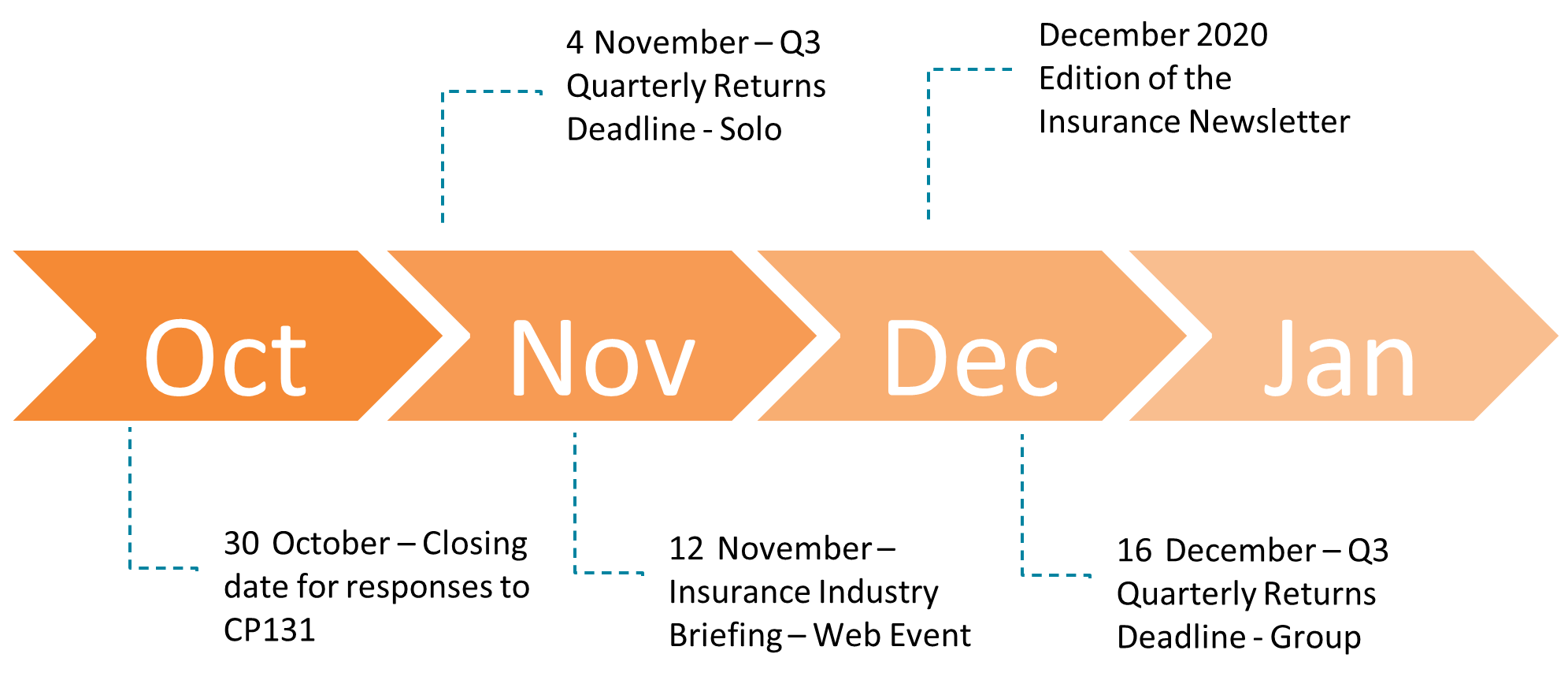

The Bank discuss their consultation on regulations for a pre-emptive recovery planning for (re)insurers, which contain proposals to introduce formal recovery planning requirements. The paper was published on 25th June and is open for comment until 30th October 2020. A second draft of II’s response is available on request.

Actuaries Creating Transparent and Open Cultures

The Central Bank considers how the domestic actuarial regime creates a framework for actuaries to contribute to transparent and open cultures. In particular the Bank refers to the reputational impact of recent corporate wrongdoing on the sector.

Emerging Risks and Climate Survey

The Central Bank restate the importance of emerging risks for the sector in the medium and long term, despite the recent challenges presented by Covid 19 and plan to issue an Emerging Risk Survey later this year, with a particular focus on climate risk (including flood cover) and cyber underwriting risks. The Central Bank confirm that ways to address the challenges posed by climate change is a key strategic priority. The impact of flooding is discussed and it’s potential to increase the frequency and severity of flood risk in Ireland. The increase of cyber risk over recent years, in addition to spike of incidents during Covid 19, have prompted the Bank to further understand cyber underwriting risk exposure. The survey will be issued to a representative sample of insurers later this year. The Bank will then analyse responses and provide feedback on key observations.

Business Interruption Insurance

The Bank set out the detail of its recent publication of the Covid 19 and Business Interruption Insurance Supervisory Framework in August, which aims to seek early identification and resolution. The Bank notes that whilst some business interruption insurance policies do provide cover for the circumstances of interruption related to the outbreak of Covid19, others clearly do not. The Bank outline that where the position is unclear, a strong or reasonable argument can be made that they do provide cover. The Framework is designed to identify and monitor insurers’ approaches to these types of policies and to set out the Bank’s expectations in relation to same.

Diversity and Inclusion in the Irish Insurance Sector

The Central Bank published the report on the Thematic Assessment of Diversity and Inclusion in Insurance Firms published in July. The assessment outlined evidence of a lack of Diversity and Inclusion in a sample of 11 insurance firms. Reference is made to comment by Ed Sibley that progress in the sector is too slow and that there is a striking lack of connection between policies and senior level decision making. Key findings include absence of D&I strategy for some firms, lack of alignment between D&I strategy and overall company strategy objectives. Conclusions were that most firms survey do not prioritise D&I and there is insufficient evidence of D&I in senior recruitment and succession planning.

SCR Calculations

The Bank communicated with firms on 7th September advising that the Bank expects all insurance and reinsurance firms to submit updated SCR calculations on a quarterly basis. Furthermore, the Bank note that the resubmission of the previously submitted SCR (as currently allowed) will not be sufficient for reporting purposes.

Differential Pricing Review

The Bank published the industry letter on 8th September setting out its expectations of the pricing of insurance policies which concludes the first phase of the Consumer Protection Directorate’s Review of Differential Pricing in the Motor and Home Insurance Markets. The Review, which commenced in January 2020, is being conducted in three phases: (1) market analysis; (2) quantitative analysis and consumer insight; and (3) findings and recommendations. The purpose of this first phase was to establish the extent of usage of differential pricing, and where it does exist, to determine how undertakings are utilising the practice and whether it is in line with the Consumer Protection Code. The Bank has identified a number of weaknesses in the market analysis phase that are of sufficient concern and these have been communicated to insurance undertakings. Phase 2 of the Review (Quantitative analysis and consumer insight) is already underway and the Bank will determine further actions based on the outcomes of this next stage.

Other topics include:

· Insurance Industry Briefing 12 November 2020 via an online platform.

· The Central Bank Portal

· Central Bank Services Standards

· Covid 19 Information Hub

EIOPA updates

The newsletter also refers to a number of EIOPA updates including EIOPA’s launch of a Single Rulebook; EIOPA’s Risk Dashboard published on 17th August which demonstrate that the risk exposure of the EU insurance sector remains high as a result of Covid 19 pandemic and EIOPA’s report on the impact of ultra-low yields insurance sector, including effects of Covid 19 crisis. The impact of a ‘low for long’ scenario present challenges noted included asset allocation, profitability, solvency issues and business model adaptation.

Recent Speeches

|

Date |

Topic |

Link |

|

September 2020 |

COVID-19 and the future of monetary policy – by Governor Gabriel Makhlouf |

https://www.centralbank.ie/news/article/speechcovid-19-mon-policy-governor-makhlouf-14-sep2020 |

|

June 2020 |

Protecting Consumers, Investors and SMEs during Covid-19 – by Director General Derville Rowland |

|

|

March 2020 |

Gender Diversity for Policy Making, a Central Banking Perspective – by Deputy Governor Sharon Donnery |

The full newsletter is available here.