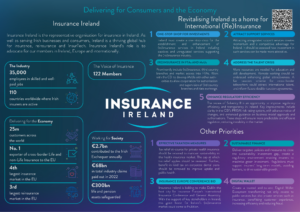

With the General Election in full swing, Insurance Ireland has created two documents to inform politicians about the insurance industry. Our General Election Poster highlights the role that the insurance industry plays both for society and the economy. Meanwhile, our Motor Insurance Factsheet takes a look at some of the data behind recent trends in motor insurance prices.

Ireland’s insurance market has undergone quite a lot of change in recent years thanks to the introduction of significant reforms and now as we look toward the future of Ireland’s insurance market, these reforms can be capitalised on by revitalising Ireland as a home for (re)insurers.

This strategy can bring significant benefits for consumers and businesses, while reducing barriers to market entry will foster a welcoming spirit making Ireland a strong contender for attracting international (re)insurers. A more competitive and innovative market will make insurance more accessible for all while continuing Ireland’s tradition as a key global insurance market.

Insurance Ireland\’s Vision: A Thriving Global Hub

As you can see in the General Election Poster, Insurance Ireland’s strategy focuses on several key policy changes that will boost Ireland\’s appeal to international insurers. One of the fundamental pieces of the strategy is the creation of a “one-stop-shop”. This will act as a single source of information and processes for insurers getting set up or expanding their services in Ireland. The proposals also include targeting regulatory reforms targeting inefficiencies and enhancing transparency, making Ireland’s regulatory regime more predictable and attractive to potential market entrants.

Ireland is already the 4th largest insurance market in the EU, and the insurance industry contributes significantly to the economy, with billions paid annually in tax, as well as providing over 35,000 high-skilled jobs and serving customers in over 110 countries worldwide. But with the continued investment in the infrastructure and regulatory environment, Insurance Ireland believes that Ireland can become the global leader in (re)insurance, driving growth, investment, and innovation across the sector.

Lower Insurance Premiums: A Direct Benefit for Consumers

One of the most significant impacts of these efforts will be on the cost of insurance for consumers and businesses. In recent years, premiums for motor insurance in Ireland have seen a decrease, with average premiums falling by 21% between 2017 and 2023. Thanks to reforms in the insurance landscape, Irish consumers have benefitted from lower premiums, and in 2023, the average motor insurance premium was just €568.

These positive changes demonstrate how a competitive and well-regulated market can benefit consumers by driving down costs. As the plans for revitalising Ireland as a global insurance hub take shape, consumers can expect even more cost savings through greater competition and improved market dynamics.

The Hidden Cost of Claims: Rising Legal Fees

While the future looks promising for lower premiums, the claims environment remains a major challenge. Our Motor Insurance Factsheet shows that a key issue highlighted by both Insurance Ireland and recent data from the Central Bank is the rising cost of legal fees. In 2023, legal costs made up nearly half of the total cost of claims in litigated cases. Specifically, in claims settled for less than €100,000, legal fees accounted for 46% of the total claim costs. This has put significant pressure on the overall claims environment, driving up the cost of insurance for everyone.

The high cost of legal fees is particularly concerning given the broader increase in damage claim costs, which have surged by 118% since pre-pandemic levels. While the reforms made in the claims environment such as the introduction of Personal Injuries Guidelines has improved the claims experience, tackling the growing burden of legal fees will require targeted reforms in the litigation process.

A Call to Action: Addressing the Legal Costs Crisis

Insurance Ireland is advocating for a more efficient legal framework to ensure that consumers can access the compensation they deserve without incurring exorbitant legal costs. Streamlining the litigation process, promoting alternative dispute resolution methods, and introducing caps on legal fees could help reduce the financial burden on insurers, which in turn would help lower premiums for consumers and businesses.

Conclusion

In conclusion, the revitalisation of Ireland’s (re)insurance market offers a bright future for both consumers and businesses. Insurance Ireland’s suggestions to enhance the country’s status as a global insurance hub will bring significant benefits, including lower premiums and greater access to insurance. However, to ensure that these benefits are fully realised, more needs to be done to address the rising costs of legal fees, which continue to strain the claims environment. By focusing on both market improvements and legal reforms, Ireland can build a more sustainable, affordable insurance system for all.

You can find our two publications below

Click to view fullscreen General Election Poster

Click to view fullscreen Motor Insurance Factsheet