The Insurance Recovery and Resolution Directive (“IRRD”) was published in the Official Journal of the European Union on 8 January 2025. The Directive enters into force on 28 January 2025 and will require Member States to adopt their national implementing rules by 29 January 2027. Requirements under the Directive will apply to all in-scope entities from 30 January 2027.

The IRRD establishes a harmonised framework for the recovery and resolution of EU (Re)insurance undertakings and, providing new powers to resolution authorities to manage failing entities as an alternative to insolvency proceedings. Under the Directive, each Member State is required to establish an insurance resolution authority.

The IRRD also provides for the creation of resolution colleges which will play a role in the decision-making process to address cross-border issues for insurance groups. The college will be chaired by the group-level resolution authority and will include, amongst others, EIOPA, the resolution authorities of the home Member States of all group insurance companies, and the Member States in which those companies carry on significant cross-border activities along with the group supervisor and the supervisory authorities in each Member State whose resolution authority is a member of the college.

Scope and Applicability

The Directive will apply to all EU insurance and reinsurance companies that fall within the scope of Solvency II, EU insurance holding companies and EU mixed financial holding companies. However, IRRD does not apply to other EU holding companies (such as “mixed-activity insurance holding companies“) or other financial institutions that are subsidiaries of holding companies covered by the Directive. In relation to EU subsidiaries or branches of third-country (re)insurance undertakings, the IRRD generally promotes cooperation between Member States and third countries (and their respective resolution authorities). However, in particular, such entities are supposed to stay subject to IRRD rules if they are not subject to third-country resolution proceedings that are recognised and applied by the relevant National Resolution Authority (NRA). Some provisions also apply to group entities that provide goods or services needed to maintain the continuous functioning of the operations of an insurance company or to ensure continuity of insurance coverage and to EU branches of non-EU insurance companies.

EIOPA will adopt guidelines on the criteria for determining when simplified planning obligations can apply to smaller or less significant insurance companies or groups.

Recovery Planning Obligations

Member State supervisors may require (stand-alone) insurance companies that are not part of an insurance group to prepare individual pre-emptive recovery plans and group supervisors may require the ultimate EU parent undertaking of an insurance group to prepare a group pre-emptive recovery plan. Supervisors will determine the application of these requirements on a proportional basis, but supervisors will in any case have to ensure that these plans cover at least 60% (determined by gross written premiums) of the relevant insurance markets in a Member State and include all insurance companies subject to resolution planning.

Insurers will have to submit the plans to the appropriate supervisor for review. Plans will be updated at least every two years, or when there is a material change in the insurer or group’s legal or organisational structure, business or financial situation or if there is a change to its financial position (for example, as a result of an acquisition or other corporate restructuring).

The plans will have to address the remedial action that the company or group may take, against a framework of indicators of the points at which remedial action will be considered, in the context of a range of scenarios of severe macroeconomic and financial stress, including system-wide events, idiosyncratic stress events and combinations of both events.

Under Regulations in already in place firms in Ireland will have already prepared pre-emptive recovery plans. Such pre-emptive recovery plans may be leveraged in recovery planning under the IRRD, but the level of convergence between the two regimes will remain uncertain until RTS and Guidelines are completed.

EIOPA will adopt guidelines on the criteria for determining when simplified planning obligations can apply to smaller or less significant insurance companies or groups. The supervisory authority will have powers to direct the remediation of deficiencies in the plan and impediments to recovery.

Resolution Planning

Resolution authorities under the IRRD will have the power to prepare resolution plans for insurance companies not part of a group subject to group resolution planning. Resolution authorities may also prepare plans for insurance companies or holding companies within a group where no group plan exists. Small and non-complex undertakings under Solvency II are out of scope of resolution planning.

Plans are required when resolution action is deemed more likely to be in the public interest in the event of an insurance company’s failure or if the company performs a critical function. Critical functions are defined as services or activities that cannot be readily substituted and whose absence would significantly impact the financial system or the real economy. These assessments consider the company’s size, business model, risk profile, interconnectedness, substitutability, and cross-border activity. Supervisors must ensure that these plans cover at least 40% of the relevant insurance markets in their Member State.

Resolution plans will outline options for applying resolution tools and powers, demonstrate how critical functions and core business lines can be separated, identify potential impediments to resolution and measures required to remove those impediments, and identify available sources of funding.

Resolution Actions

Under the IRRD, resolution authorities may only take resolution actions, i.e., place an entity under resolution, apply resolution tools and exercise resolution powers in relation to insurance undertakings and groups where:

(a) an in-scope undertaking is failing or likely to fail;

(b) there is no reasonable prospect that any alternative private measure or supervisory actions would prevent the failure within a reasonable time frame; and

(c) the resolution action is necessary in the public interest. A (Re)insurance undertaking is considered to be “failing or likely to fail” if:

- It is in breach or likely to breach its MCR and it is considered there is no reasonable prospect of compliance being restored.

- It no longer fulfils conditions for its authorisation, fails seriously in its legal or regulatory obligations, or there is objective evidence that it will do so in the future in a way that would justify withdrawing authorisation.

- The value of its assets is (or there is objective evidence that it will be) less than its liabilities.

- It is (or there is objective evidence that it will be) unable to pay its debts or other liabilities when they fall due.

- Considerable public finance support is required.

Resolution Tools

The IRRD provides resolution authorities with five primary resolution tools to manage failing (Re)insurance companies.

- Solvent Run-Off: This tool prohibits the writing of new business and the payment of dividends and allows the run-off of existing contracts to facilitate the continuation of the undertaking’s activities until its liquidation.

- Sale-of-Business: This tool enables the transfer of shares or all or part of the assets and liabilities to a purchaser on commercial terms. If only a partial transfer occurs, the residual entity is wound up.

- Bridge Undertaking: This involves transferring shares or all or part of the assets and liabilities to a bridge undertaking controlled by public authorities or, at the Member State’s option, an insurance guarantee scheme. The bridge undertaking may write new business with the aim of achieving an eventual sale, whereas an insurance guarantee scheme may not write new business and aims to guarantee the settlement of claims. If a partial transfer occurs, the residual entity is wound up.

- Asset and Liability Separation Tool: Impaired or problematic assets and/or liabilities may be transferred to a publicly controlled management vehicle. This tool allows the transfer of all or part of the assets and liabilities to asset and liability management.

- Write-Down and Conversion Tool (Bail-In): This tool provides the power to write down capital instruments and eligible liabilities or convert them to shares. All insurance and other liabilities are eligible except for certain secured, short-term, and operational liabilities, as well as certain liabilities arising from compulsory motor insurance.

These tools can be used individually or in combination, except for the asset and liability separation tool, which must be used together with another resolution tool.

Resolution authorities have additional powers to support resolution actions, including restructuring insurance claims, cancelling or modifying contracts, controlling the entity under resolution, exercising rights of shareholders and directors, replacing management, and requiring group entities to provide operational services or facilities to support the entity under resolution. They can also ensure the continuation of essential goods or services provided by group entities, even if the provider is insolvent.

The IRRD also overrides certain contractual clauses triggered by the exercise of preventive or resolution powers and allows resolution authorities to stay the performance of obligations, termination of contracts, or enforcement of security interests for a short period after taking resolution action. Additionally, resolution authorities can temporarily restrict or suspend redemption rights of policyholders in relation to life insurance contracts.

Next Steps

EIOPA Consultations

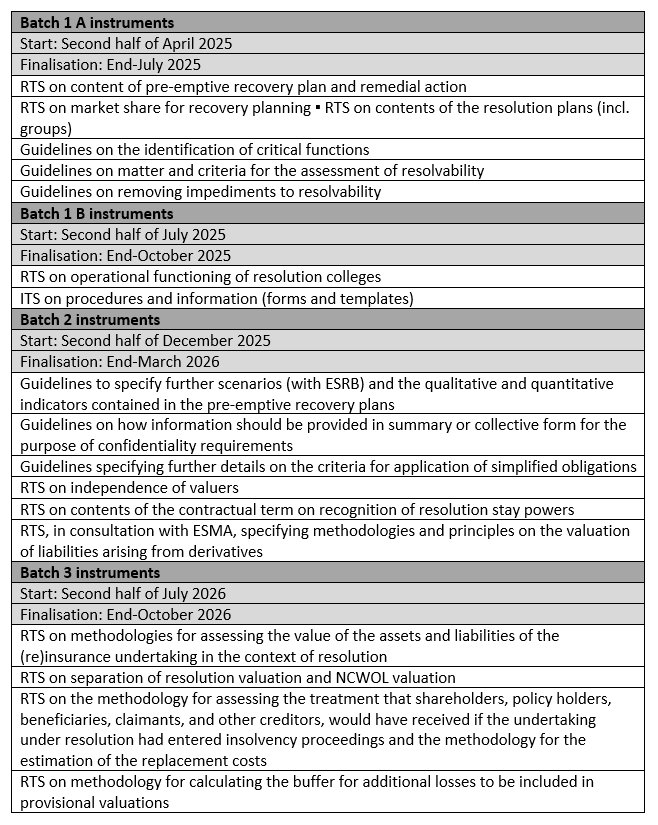

EIOPA is mandated to consult on and publish guidelines and deliver drafts of regulatory technical standards (RTS) and implementing technical standards (ITS) for adoption by the Commission.

Insurance Ireland will engage in the consultation process and looks forward to liaising with our Members in providing industry responses to the items raised in the various consultations.